Effective Techniques for Growing Organic Subscribers on YouTube

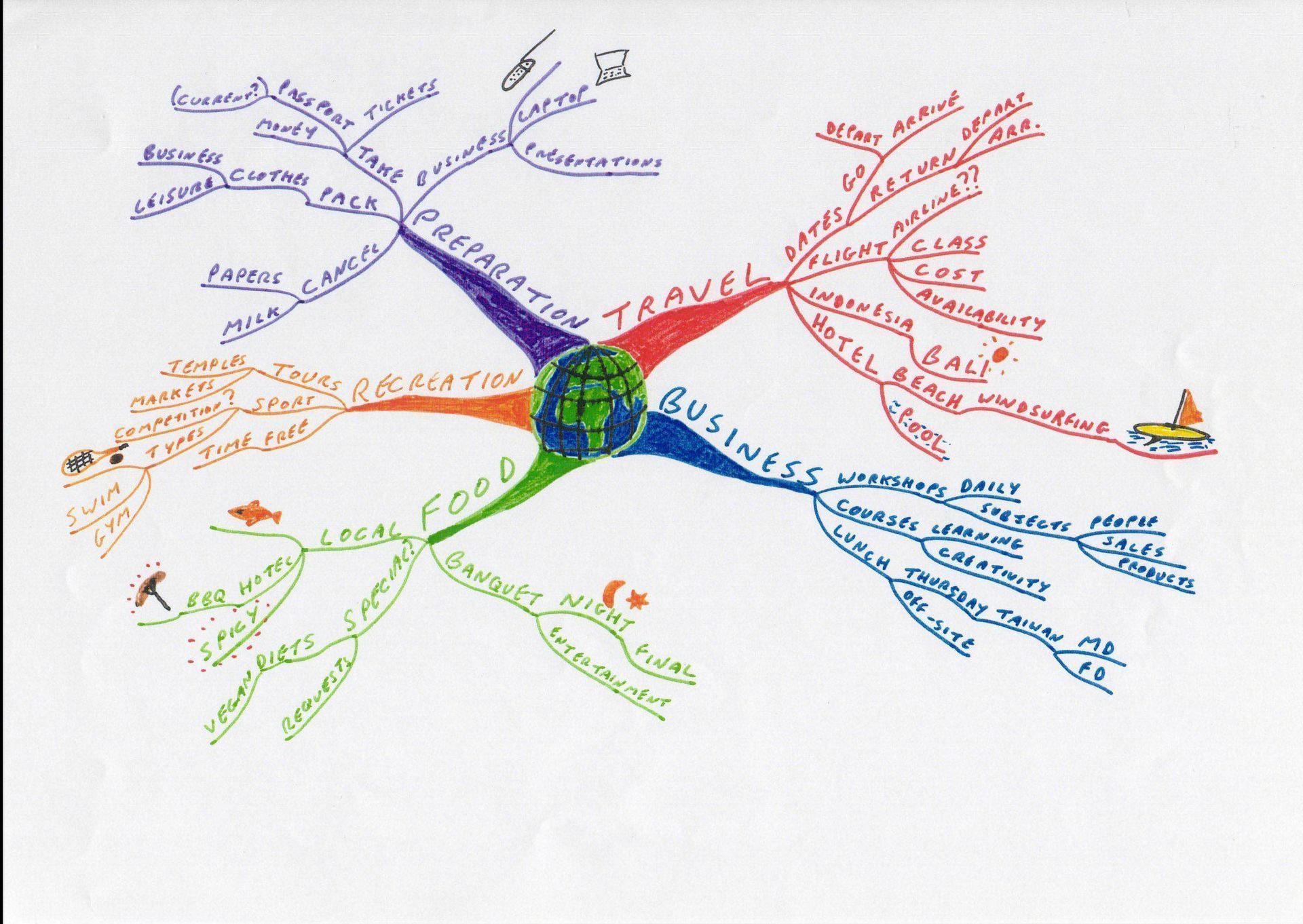

Understanding the YouTube Algorithm

Before we talk about how to grow your YouTube following, it’s important we understand how YouTube works. The platform’s algorithm focuses on keeping viewers happy. This means that the more likes, comments, and shares your videos get, the more likely they are to be suggested to new viewers. Watch time and click-through rate are also really important. Find more relevant information about the subject through the thoughtfully chosen external source. youtube subscribers, gain supplementary insights.

Creating Great Videos

The most important thing to grow your subscribers on YouTube is to make great, interesting videos that your viewers will want to watch. Find your niche and make videos that give something useful to your viewers. Use nice pictures, interesting titles, and well-written descriptions to get people to watch your videos. By always making good videos, you’ll get loyal subscribers over time.

Making Your Videos Easy to Find

To make sure people can find your videos and they show up in search results, you need to use words that people are looking for in your videos. This is called “keywords.” Put these words in your video titles, descriptions, and tags. It’s also helpful to write down what you’re saying in the video and make the words show up as captions.

Talking to Your Viewers

To grow your subscribers naturally on YouTube, it’s really important to have conversations with your viewers. Answer their comments, do Q&A videos, and show your live videos. This makes your viewers feel like …